Budgeting : A Step-by-Step Guide

Creating a budget is an essential step towards financial stability and success. By carefully managing your expenses and income, you can ensure that your money is working for you and help achieve your financial goals. In this comprehensive guide, we’ll walk you through the process of creating a budget from your pay, providing practical tips and strategies to help you take control of your finances and build a secure financial future.

Assess Your Income

The first step in creating a budget is to determine your total income. This includes your regular salary or wages, as well as any additional sources of income such as bonuses, commissions, or freelance work. Calculate your net income after taxes and deductions to get an accurate picture of the money you have available to budget with.

Track Your Expenses

Next, track your expenses over a set period, such as a month, to understand where your money is going. This includes fixed expenses like rent or mortgage payments, utilities, insurance, and loan payments, as well as variable expenses such as groceries, dining out, entertainment, and transportation. Use receipts, bank statements, or budgeting apps to help you keep track of your spending.

Identify Financial Goals

Consider your short-term and long-term financial goals and priorities. These may include building an emergency fund, paying off debt, saving for a down payment on a home, or investing for retirement. By identifying your goals, you can allocate your money accordingly and prioritize spending in areas that align with your objectives.

Create a Budget

Using the information gathered from assessing your income and tracking your expenses, create a budget that outlines how you will allocate your money each month. Start by listing your income at the top and then subtracting your fixed expenses. Next, allocate funds for your variable expenses, savings, and financial goals. Be realistic and flexible with your budget, allowing for unexpected expenses or adjustments as needed.

Monitor and Adjust

Once you’ve created your budget, it’s important to monitor your spending regularly and make adjustments as necessary. Review your budget monthly to ensure that you’re staying on track with your financial goals and making progress towards achieving them. If you find that you’re consistently overspending in certain areas, consider making adjustments to your budget or finding ways to reduce expenses. Additionally, if you’re looking for some entertainment, you can try your luck at online casino gambling site.

Build an Emergency Fund

One of the cornerstones of financial stability is having an emergency fund to cover unexpected expenses or financial emergencies. Aim to save at least three to six months’ worth of living expenses in an easily accessible savings account. Start small by setting aside a portion of your income each month until you reach your savings goal.

Seek Professional Advice

If you’re unsure about creating or managing your budget, consider seeking advice from a financial advisor or planner. A professional can help you assess your financial situation, set realistic goals, and develop a personalized budgeting strategy to help you achieve your objectives.

Conclusion

Therefore, creating a budget from your pay is a fundamental step towards achieving financial stability and success. Also, by assessing your income, tracking your expenses, identifying financial goals, and creating a budget that aligns with your objectives, you can take control of your finances and build a secure financial future. Moreover, with discipline, perseverance, and smart money management, you can achieve your financial goals and enjoy peace of mind knowing that your finances are in order.

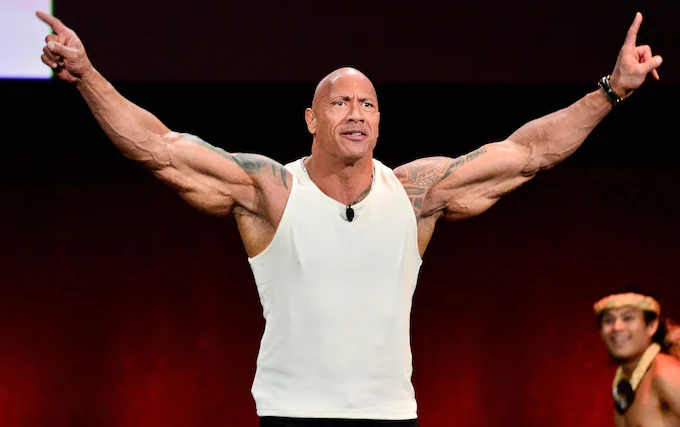

The Rock: Dominance in WWE History

In the annals of WWE history, few names evoke as much awe, admiration, and respect as Dwayne “The Rock” Johnson. From his electrifying charisma to his powerhouse performances, The Rock’s dominance in the world of professional wrestling is a legacy carved in stone. In this article, we’ll take a closer look at The Rock’s unparalleled impact on WWE history and how he became one of the most iconic and influential figures in the industry.

Rise to Prominence

Dwayne Johnson’s journey to WWE superstardom began in the mid-1990s when he made his debut as Rocky Maivia, a third-generation wrestler with boundless potential. Despite initial skepticism from fans and critics, Johnson quickly won over audiences with his electrifying charisma, dynamic in-ring style, and undeniable talent. His meteoric rise to prominence culminated in his transformation into The Rock, a larger-than-life persona that would change the landscape of professional wrestling forever.

Championship Reigns and Main Event Matches

Throughout his WWE career, The Rock’s dominance was exemplified by his numerous championship reigns and memorable main event matches. From winning the WWE Championship to headlining WrestleMania events, The Rock’s presence in the ring was synonymous with excitement, anticipation, and sheer entertainment. His rivalries with iconic wrestlers such as Stone Cold Steve Austin, Triple H, and John Cena are there in the annals of WWE history, producing some of the most memorable moments in sports entertainment.

Electrifying Promos and Catchphrases

One of The Rock’s greatest strengths was his ability to captivate audiences with his electrifying promos and unforgettable catchphrases. From “If you smell what The Rock is cooking!” to “Just bring it!” and “Layeth the smackdown,” The Rock’s mic skills were second to none, earning him a legion of fans and establishing him as a true master of the microphone. His unique blend of humor, charisma, and confidence made every promo a must-see event, further solidifying his status as a WWE icon.

Crossing Over to Hollywood

In addition to his success in the world of professional wrestling, The Rock’s charisma and talent transcended the confines of the squared circle, leading to a successful career in Hollywood. As one of the highest-grossing actors in the world, Dwayne Johnson has starred in blockbuster films, television shows, and even his own production company, further cementing his status as a global superstar.

Legacy and Influence

The Rock’s influence on WWE history extends far beyond his championship reigns and main event matches. His impact on the industry can be felt in the careers of countless wrestlers who have through inspiration by his example, as well as in the long popularity and success of WWE as a global brand. The Rock’s legacy is not just one of dominance in the ring, but also of inspiration, innovation, and excellence—a legacy that will continue to endure for generations to come.

Conclusion

In conclusion, Dwayne “The Rock” Johnson’s dominance in WWE history is a testament to his unparalleled talent, charisma, and work ethic. From his electrifying performances to his championship reigns and iconic catchphrases, The Rock’s impact on the world of professional wrestling is indelible. As a true trailblazer and pioneer, The Rock’s legacy will continue to inspire and entertain wrestling fans around the world for years to come, ensuring that his place in WWE history remains firmly etched in stone.

Dwayne Johnson: From Wrestling Superstar to Hollywood Icon

Dwayne ‘The Rock’ Johnson is a name synonymous with charisma, talent, and unparalleled success. From his electrifying performances in the wrestling ring to his blockbuster hits on the silver screen, The Rock has captivated audiences around the world with his larger-than-life persona and undeniable charm. In this exploration, we delve into the remarkable life and wrestling journey of Dwayne ‘The Rock’ Johnson, tracing his path from wrestling superstardom to becoming a Hollywood icon.

Early Life and Wrestling Beginnings

Born into a family with deep roots in professional wrestling, Dwayne Douglas Johnson, known affectionately as ‘The Rock,’ was destined for greatness from the start. Growing up surrounded by wrestling legends like his father, Rocky Johnson, and his grandfather, Peter Maivia, The Rock’s passion for the sport was ignited at an early age. After a brief stint playing football in college and the Canadian Football League, he followed in his family’s footsteps and joined the world of professional wrestling.

Rise to Prominence in the WWE

Debuting as Rocky Maivia in the WWE (then WWF) in 1996, Dwayne Johnson quickly made a name for himself with his unparalleled athleticism, magnetic personality, and electrifying charisma. With his trademark catchphrases, eyebrow raises, and devastating finishing move, The Rock became one of the most beloved and iconic figures in WWE history. His rivalries with legendary wrestlers like Stone Cold Steve Austin, Triple H, and The Undertaker solidified his status as a wrestling icon, earning him multiple championships and legions of fans around the world.

Transition to Hollywood Stardom

Building on his success in the wrestling ring, Dwayne Johnson set his sights on conquering Hollywood. With his undeniable star power and natural acting talent, The Rock quickly rose through the ranks, landing roles in blockbuster films such as “The Scorpion King,” “The Fast and the Furious” franchise, and “Jumanji: Welcome to the Jungle.” His ability to seamlessly transition between action-packed thrillers, family-friendly comedies, and heartfelt dramas showcased his versatility as an actor and solidified his status as a leading man in Hollywood.

Impact and Legacy

Throughout his career, Dwayne ‘The Rock’ Johnson has not only entertained audiences but also inspired millions with his relentless work ethic, unwavering determination, and commitment to excellence. Whether he’s electrifying the wrestling world with his epic promos or dominating the box office with his blockbuster films, The Rock’s impact on pop culture is undeniable. Beyond his professional achievements, he’s also influential for his philanthropy work and positive influence on fans worldwide, earning him a permanent place in the hearts of millions.

Conclusion

Dwayne ‘The Rock’ Johnson’s journey from wrestling superstar to Hollywood icon is a testament to the power of passion, perseverance, and self-belief. With his larger-than-life personality, magnetic charisma, and unparalleled work ethic, The Rock has transcended the worlds of sports and entertainment, leaving an indelible mark on pop culture and inspiring generations to chase their dreams. Also, as he continues to conquer new challenges and break new ground, The Rock’s legacy as one of the greatest entertainers of all time is amazing, cementing his status as a true legend in the annals of history. Explore the world of online entertainment further by visiting online casino australia, where you can experience the excitement of gaming from the comfort of your own home.

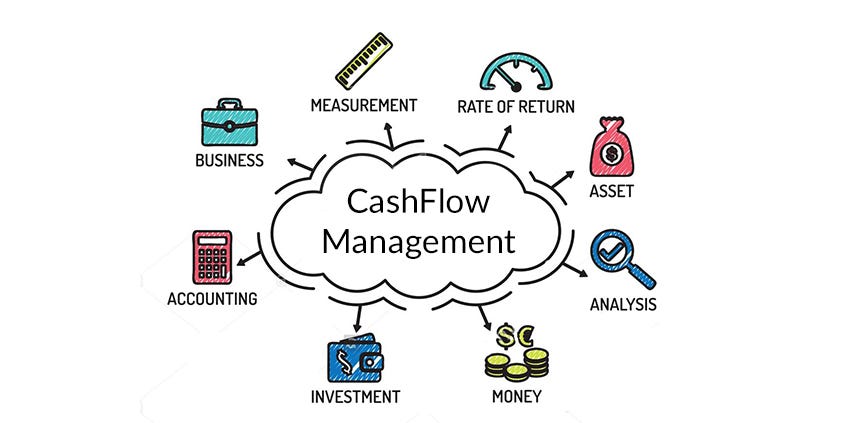

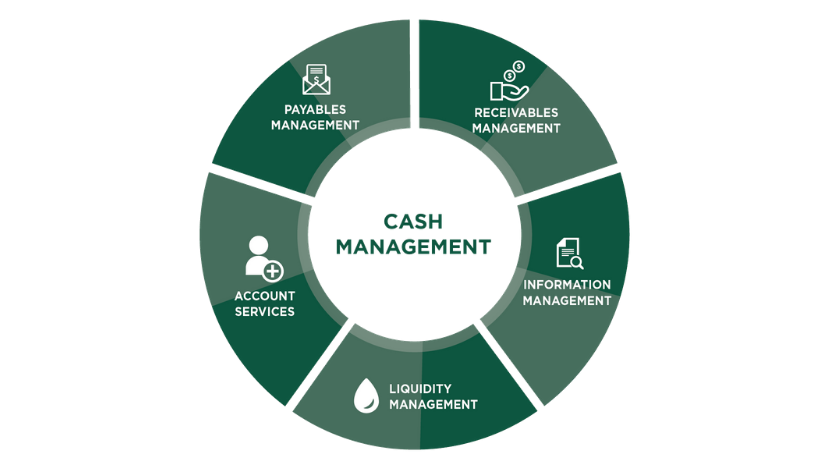

Business cash flow management

Cash flow management is crucial for the success and sustainability of any business. Properly managing the money that circulates within your business ensures that you can cover expenses, invest in growth opportunities, and maintain financial stability. In this comprehensive guide, we’ll explore essential tips and strategies for managing the cash flow in your business effectively.

1. Optimize Revenue

- Diversify Revenue Streams: Explore multiple income sources to reduce reliance on a single revenue stream and minimize the impact of market fluctuations.

- Improve Sales and Marketing: Invest in effective sales and marketing strategies to attract new customers, retain existing ones, and increase sales revenue.

- Streamline Payment Processes: Implement efficient billing and payment systems to accelerate cash inflows and reduce payment delays.

2. Control Expenses

- Monitor and Analyze Expenses: Regularly review your business expenses to identify areas where costs can be reduced or eliminated.

- Negotiate with Suppliers: Negotiate favorable terms with suppliers to secure discounts, extend payment terms, or explore alternative suppliers offering better prices.

- Cut Unnecessary Costs: Eliminate non-essential expenses and prioritize spending on activities that contribute to business growth and profitability.

3. Forecast Cash Flow

- Create Cash Flow Projections: Develop cash flow forecasts to predict future income and expenses, allowing you to anticipate cash shortages or surpluses.

- Monitor Cash Flow Regularly: Keep track of actual cash flows against projected figures and adjust forecasts accordingly based on changing market conditions or business circumstances.

- Plan for Contingencies: Prepare contingency plans to address potential cash flow challenges, such as securing lines of credit or building cash reserves.

4. Maintain Financial Stability

- Build Cash Reserves: Accumulate cash reserves to cover unexpected expenses, economic downturns, or periods of reduced revenue.

- Manage Debt Effectively: Avoid excessive debt and prioritize paying off existing liabilities to reduce interest expenses and improve financial health.

- Invest Wisely: Evaluate investment opportunities carefully and focus on investments that offer long-term growth potential while minimizing risks.

5. Utilize Technology

- Implement Accounting Software. Use accounting software to automate financial processes, track income and expenses, and generate financial reports for better decision-making.

- Explore Cash Flow Management Tools. Consider using cash flow management tools or software that provide insights into cash flow patterns, trends, and forecasts.

Conclusion

Effective cash flow management is essential for the financial health and success of your business. By optimizing revenue, controlling expenses, forecasting cash flow, maintaining financial stability, and leveraging technology, you can ensure that your business remains resilient and adaptable in the face of economic challenges and opportunities. reelsofjoy.io casino, an online casino site, offers additional opportunities for financial management through its gaming platform. Implementing these strategies will help you maintain a positive cash flow, support growth initiatives, and achieve long-term financial sustainability.

Rice and Chicken: Tips for Delicious and Flavorful Meals

Rice and chicken are staple ingredients in many cuisines around the world, and for good reason – they’re versatile, affordable, and delicious when prepared correctly. In this blog post, we’ll share expert tips to help you elevate your rice and chicken dishes to new heights. From selecting the right ingredients to mastering cooking techniques, you’ll learn everything you need to know to create mouthwatering meals that are sure to impress.

Choose Quality Ingredients

The key to delicious rice with chicken dishes starts with selecting high-quality ingredients. Opt for fresh, organic chicken whenever possible, and choose long-grain or basmati rice for a fluffy and aromatic texture.

Marinate Your Chicken

Marinating your chicken before cooking is a simple yet effective way to infuse flavor and moisture into the meat. Experiment with different marinades, such as lemon herb, garlic soy, or spicy barbecue, and allow the chicken to marinate for at least 30 minutes to overnight for maximum flavor.

Season Generously

Don’t be shy when it comes to seasoning your rice and chicken dishes. Use a variety of herbs, spices, and seasonings to add depth and complexity to your meals. Common seasonings for chicken include salt, pepper, garlic powder, paprika, and thyme, while rice can be enhanced with ingredients like turmeric, cumin, cinnamon, and bay leaves.

Master Cooking Techniques

Cooking rice and chicken to perfection requires mastering basic cooking techniques. For rice, use the absorption method (2:1 water to rice ratio) for fluffy grains or the pilaf method for a more flavorful dish. When cooking chicken, aim for an internal temperature of 165°F (74°C) to ensure that it’s cooked through but still juicy and tender.

Add Layers of Flavor

Take your rice and chicken dishes to the next level by incorporating layers of flavor. Consider adding aromatics like onions, garlic, and ginger to your rice, or topping your chicken with a flavorful sauce or glaze for added moisture and taste.

Experiment with Cooking Methods

Don’t limit yourself to just one cooking method – experiment with different techniques to discover new flavors and textures. Try grilling, roasting, sautéing, or even slow cooking your chicken for a variety of delicious results.

Balance Flavors and Textures

A well-balanced rice and chickens dish should have a harmonious blend of flavors and textures. Pair juicy and tender chicken with fluffy and fragrant rice, and add crunchy vegetables or nuts for an extra layer of texture and freshness.

Garnish and Serve with Care

Presentation is key when it comes to serving rice with chickens dishes. Garnish your meals with fresh herbs, sliced scallions, or toasted sesame seeds for a pop of color and flavor. Serve with a side of steamed vegetables or a crisp salad to complete the meal.

Practice Patience

Good things take time, and cooking rice and chicken is no exception. Be patient and allow your ingredients to cook slowly and evenly, taking care not to rush the process. The end result will be well worth the wait.

Enjoy the Process

Cooking should be an enjoyable and rewarding experience, so don’t forget to have fun in the kitchen! Experiment with different flavors, get creative with your recipes, and savor the satisfaction of creating delicious meals for yourself and your loved ones.

Conclusion

With these expert tips and techniques, you’ll be well on your way to mastering the art of cooking rice and chickens. Whether you’re preparing a simple weeknight dinner or hosting a special gathering, these tips will help you create memorable and mouthwatering meals that everyone will love.

Money-Saving Tips: For Savings and Achieve Financial Goals

In today’s fast-paced world, saving money has become more important than ever. Whether you’re looking to build an emergency fund, save for a big purchase, or plan for retirement, having a solid savings strategy is crucial. In this blog post, we’ll explore some practical money-saving tips to help you achieve your financial goals and secure your future.

Create a Budget

One of the most effective ways to save money is to create a budget and stick to it. Start by tracking your income and expenses to get a clear picture of your financial situation. Then, allocate your money towards essential expenses, savings, and discretionary spending. Be sure to review and adjust your budget regularly to reflect changes in your income and expenses.

Set Savings Goals

Setting specific savings goals can help you stay motivated and focused on your financial objectives. Whether you’re saving for a down payment on a house, a dream vacation, or retirement, having clear goals in mind can make it easier to prioritize your spending and make smarter financial decisions.

Automate Your Savings

Take advantage of automation tools to make saving money easier and more convenient. Set up automatic transfers from your checking account to your savings account each month to ensure that you’re consistently putting money away towards your goals. You can also use apps and online tools to track your progress and monitor your savings habits.

Cut Back on Expenses

Look for opportunities to cut back on unnecessary expenses and save money. Evaluate your monthly bills and subscriptions to see if there are any services you can cancel or downgrade. Consider shopping around for better deals on essentials like insurance, phone plans, and utilities. Small changes can add up to significant savings over time.

Embrace Frugal Living

Adopting a frugal mindset can help you live within your means and save money without sacrificing your quality of life. Look for ways to reduce your spending on non-essentials, such as dining out less frequently, buying generic brands instead of name brands, and finding free or low-cost forms of entertainment.

Shop Smart

Practice smart shopping habits to stretch your dollars further. Compare prices and look for sales, discounts, and coupons before making a purchase. Consider buying in bulk for items you use regularly, and avoid impulse purchases by sticking to a shopping list.

Reduce Debt

Paying off high-interest debt can free up more money in your budget for savings and other financial goals. Focus on paying down your debt strategically, starting with the highest-interest balances first. Consider consolidating or refinancing your debt to lower your interest rates and make repayment more manageable.

Invest Wisely

Investing can be an effective way to grow your wealth and achieve long-term financial security. Consider working with a financial advisor to develop an investment strategy that aligns with your goals, risk tolerance, and time horizon. Diversify your investments to minimize risk and maximize potential returns.

Practice Mindful Spending

Before making a purchase, take a moment to consider whether it aligns with your values and priorities. Avoid impulse buys and ask yourself if the item is something you truly need or if it will bring you long-term satisfaction. By practicing mindful spending, you can avoid wasting money on things that don’t contribute to your overall well-being.

Track Your Progress

Finally, track your progress towards your savings goals regularly to stay motivated and accountable. Celebrate your successes along the way, and don’t be discouraged by setbacks. By staying focused on your goals and making saving money a priority, you can achieve financial success and build a brighter future for yourself and your loved ones.

Conclusion

By incorporating these money-saving tips into your lifestyle, you can take control of your finances, build your savings, and achieve your long-term financial goals. Remember that saving money is a journey, and every small step you take towards financial responsibility brings you closer to a secure and prosperous future.

Black Forest Cake Variations

The Black Forest cake, also known as Schwarzwälder Kirschtorte, is a beloved dessert that tantalizes taste buds with its rich chocolate layers, tart cherries, and creamy whipped cream. Originating in the Black Forest region of Germany, this iconic cake has captured hearts (and stomachs) worldwide.

But the Black Forest story doesn’t end with the classic recipe. This versatile dessert offers a delightful canvas for creative variations, allowing bakers to explore different flavor profiles and cater to diverse palates. Here, we embark on a delectable journey through the world of Black Forest cake variations:

The Classic Black Forest: A Timeless Tradition

The quintessential Black Forest cake features moist chocolate sponge layers soaked in kirschwasser (a cherry brandy) syrup, layered with sweet and tart cherries, whipped cream, and decorated with maraschino cherries and chocolate shavings. This classic version remains a crowd-pleaser, offering a perfect balance of sweet, tart, and boozy flavors.

Regional Twists on the Black Forest Tradition

Germany itself boasts regional variations on the Black Forest cake, each showcasing unique local flavors:

- Black Forest Cake with Kirsch (Kirschwasser Schwarzwälder Kirschtorte): This version incorporates kirschwasser not just in the syrup, but also in the whipped cream, adding an extra layer of boozy complexity.

- Black Forest Cake with Sour Cherries (Schwarzwälder Kirschtorte mit Sauerkirschen): Traditional recipes often call for sour cherries, while some modern variations use sweeter maraschino cherries. Sour cherries add a delightful tartness, balancing the sweetness of the chocolate and whipped cream.

Embracing New Flavors: Variations for Modern Palates

Modern bakers are constantly innovating, introducing exciting twists on the Black Forest theme:

- Black Forest Cheesecake: This decadent version incorporates a cheesecake base instead of a sponge cake, creating a creamy and luxurious twist on the classic.

- Black Forest with Berries: Swap the cherries for other berries like raspberries, blueberries, or a vibrant mix for a delightfully fruity variation.

- Boozy Black Forest Variations: For those who enjoy a stronger kick, explore options like rum-soaked raisins or substituting amaretto for kirschwasser. Be mindful of alcohol content when serving to children.

- Chocolate Mousse Black Forest: Instead of whipped cream, use a light and airy chocolate mousse for a rich and decadent twist.

Vegan and Gluten-Free Black Forest

Dietary restrictions don’t have to exclude you from enjoying the Black Forest experience. Here are some creative solutions:

- Vegan Black Forest: Use vegan butter, milk alternatives, and egg substitutes to create a delicious and cruelty-free version. Vegan chocolate options and cherry fillings are readily available.

- Gluten-Free Black Forest Cake: Almond flour or other gluten-free flours can be used to create a sponge cake base suitable for those with gluten sensitivities.

Presentation Perfection

No Black Forest cake is complete without a touch of artistic flair. Here are some ideas to elevate your presentation:

- Classic Elegance: Opt for maraschino cherries, chocolate shavings, and piped whipped cream borders for a timeless elegance.

- Fruity Flourish: For a more vibrant look, decorate with fresh berries, edible flowers, or a dusting of powdered sugar.

- Chocolate Drizzle: Elevate your cake with a decadent chocolate ganache drizzle cascading down the sides.

- Themed Decorations: For special occasions, incorporate themed decorations that complement your chosen flavor variations.

A Celebration of Flavor and Creativity

From the classic recipe to modern variations, the Black Forest offers a world of flavor exploration. This versatile dessert allows you to personalize it based on your preferences and dietary needs. Whether you’re a traditionalist or a flavor adventurer, there’s a Black Forest variation waiting to tantalize your taste buds. So, grab your whisk, unleash your creativity, and embark on your own Black Forest baking journey!

Pork recipes : A Culinary Journey Through Endless Possibilities

Pork is a culinary chameleon, gracing tables worldwide in a dazzling array of dishes with its recipes. From the melt-in-your-mouth tenderness of slow-roasted pork belly to the satisfying crispness of grilled pork chops, its versatility knows no bounds. This guide unlocks the potential of pork, exploring numerous cooking methods and highlighting the best cuts for each technique.

Know Your Cuts: A Guide to Pork Varieties

To embark on this delicious journey, understanding the different cuts of pork is essential. Here’s a breakdown of some popular options and their culinary applications:

- Shoulder: This well-marbled cut benefits from slow cooking methods like braising or roasting. Perfect for pulled pork sandwiches, flavorful stews, or succulent carnitas.

- Loin: The leanest and most tender cut, ideal for grilling, pan-frying, or baking. Enjoy it as juicy pork chops, flavourful stir-fries, or delectable schnitzels.

- Tenderloin: Another exceptionally tender cut, perfect for quick cooking methods like pan-searing or grilling. Enjoy it as luxurious medallions or elegant filets.

- Belly: This fatty cut is a true crowd-pleaser. When slow-roasted, it delivers melt-in-your-mouth goodness. It’s also fantastic for crispy pork belly bites or flavorful bacon.

- Ribs: These cuts are practically synonymous with barbecue bliss. Enjoy them slow-cooked with your favorite sauce for fall-off-the-bone deliciousness.

- Ground Pork: A versatile and budget-friendly option, perfect for meatballs, sausage fillings, flavorful stir-fries, or hearty bolognese sauce.

A World of Flavor: Cooking Techniques for Pork

With a variety of cuts at your disposal, the possibilities for creating mouthwatering pork dishes are endless. Here are some popular cooking methods to consider:

-

Roasting: A slow and gentle method ideal for tougher cuts like shoulder or pork belly. This allows the fat to render, resulting in juicy and flavorful roasts.

-

Braising: This technique involves slow-cooking meat in a flavorful liquid. Perfect for transforming tougher cuts like shoulder into melt-in-your-mouth masterpieces. Think pulled pork, osso buco, or rich stews.

-

Grilling: A quintessential summer cooking method, grilling imbues pork with a smoky flavor and beautiful char. Enjoy succulent pork chops, kebabs, or juicy burgers.

-

Pan-Searing: This quick and easy method is ideal for tender cuts like pork chops or tenderloin. Searing creates a beautiful caramelized crust while locking in the juices for a flavorful and satisfying dish.

-

Stir-Frying: A perfect choice for lean cuts like pork loin or ground pork. This quick-cooking method allows you to create flavorful and healthy stir-fries packed with vegetables and your favorite sauces.

-

Smoking: This low and slow cooking method imbues pork with a unique smoky flavor and tender texture. Perfect for pulled pork, ribs, or succulent bacon.

A Culinary Adventure Awaits: Recipe Inspiration

Now that you’re armed with knowledge about pork cuts and cooking techniques, here are some recipe ideas to spark your culinary creativity:

-

Slow Cooker Honey Garlic Pork Shoulder: A fuss-free recipe that yields incredibly tender and flavorful pulled pork. Perfect for sandwiches, tacos, or flavorful salads.

-

Grilled Pork Chops with Chimichurri Sauce: A quick and easy weeknight meal. Juicy pork chops bursting with flavor, complemented by a vibrant and zesty chimichurri sauce.

-

Crispy Pork Belly with Spicy Asian Glaze: Indulge in the decadent flavors of this recipe. Slow-roasted pork belly transformed into crispy perfection with a sweet and spicy Asian glaze.

-

Pan-Seared Pork Tenderloin with Creamy Mushroom Sauce: An elegant and impressive dish. Tender pork medallions bathed in a rich and flavorful mushroom sauce for a truly luxurious dining experience.

-

Healthy Pork and Vegetable Stir-Fry: A quick and nutritious meal. Lean cuts of pork stir-fried with colorful vegetables and your favorite sauce – a flavor and health win!

This is just a glimpse into the vast world of pork cuisine. With a little exploration and experimentation, you can discover countless ways to prepare this versatile meat, creating delicious dishes that will tantalize your

Bread Recipes for Every Baker | Perfect Your Baking Skills

Are you craving the comforting aroma of freshly baked bread filling your kitchen? Look no further! Discover a selection of bread recipes that guarantee soft, pillowy loaves with a melt-in-your-mouth texture. Whether you’re a novice baker or a seasoned pro, these recipes are sure to satisfy your bread cravings and impress your friends and family.

Classic White Bread

Ingredients:

- 3 cups all-purpose flour

- 1 tablespoon sugar

- 1 teaspoon salt

- 1 packet (2 1/4 teaspoons) active dry yeast

- 1 cup warm water

- 2 tablespoons unsalted butter, melted

Instructions:

- In a large mixing bowl, combine the flour, sugar, salt, and yeast. Gradually add the warm water and melted butter, stirring until a dough forms.

- Knead the dough on a lightly floured surface for about 5-7 minutes, or until smooth and elastic.

- Place the dough in a greased bowl, cover with a clean kitchen towel, and let it rise in a warm place until doubled in size, about 1 hour.

- Punch down the dough and shape it into a loaf. Place the dough in a greased loaf pan, cover, and let it rise again until doubled in size, about 30-45 minutes.

- Preheat the oven to 375°F (190°C). Bake the bread for 25-30 minutes, or until golden brown and hollow-sounding when tapped on the bottom. Let cool before slicing.

Honey Oat Bread

Ingredients:

- 1 cup warm milk

- 2 tablespoons honey

- 1 packet (2 1/4 teaspoons) active dry yeast

- 2 1/2 cups all-purpose flour

- 1 cup old-fashioned oats

- 1/4 cup unsalted butter, melted

- 1 teaspoon salt

Instructions:

- In a small bowl, combine the warm milk, honey, and yeast. Let it sit for 5-10 minutes, or until frothy.

- In a large mixing bowl, combine the flour, oats, melted butter, salt, and yeast mixture. Stir until a dough forms.

- Knead the dough on a lightly floured surface for about 5-7 minutes, or until smooth and elastic.

- Place the dough in a greased bowl, cover, and let it rise in a warm place until doubled in size, about 1 hour.

- Punch down the dough and shape it into a loaf. Place the dough in a greased loaf pan, cover, and let it rise again until doubled in size, about 30-45 minutes.

- Preheat the oven to 350°F (175°C). Bake the bread for 30-35 minutes, or until golden brown and cooked through. Let cool before slicing.

Cinnamon Swirl Bread

Ingredients:

- 3 cups all-purpose flour

- 1/4 cup granulated sugar

- 1 packet (2 1/4 teaspoons) active dry yeast

- 1 teaspoon salt

- 1 cup warm milk

- 2 tablespoons unsalted butter, melted

- 1 large egg

- 1/2 cup brown sugar

- 2 teaspoons ground cinnamon

Instructions:

- In a large mixing bowl, combine the flour, granulated sugar, yeast, and salt. Gradually add the warm milk, melted butter, and egg, stirring until a dough forms.

- Knead the dough on a lightly floured surface for about 5-7 minutes, or until smooth and elastic.

- Place the dough in a greased bowl, cover, and let it rise in a warm place until doubled in size, about 1 hour.

- Punch down the dough and roll it out into a rectangle on a lightly floured surface.

- In a small bowl, mix together the brown sugar and cinnamon. Sprinkle the mixture evenly over the dough.

- Roll up the dough tightly from one end to the other to form a loaf. Place the dough in a greased loaf pan, cover, and let it rise again until doubled in size, about 30-45 minutes.

- Preheat the oven to 350°F (175°C). Bake the bread for 35-40 minutes, or until golden brown and cooked through. Let cool before slicing.

Enjoy Your Homemade Bread Creations!

From classic white bread to indulgent cinnamon swirl loaves, these recipes are sure to elevate your baking game and fill your home with the irresistible aroma of freshly baked bread. Experiment with different flavors and variations to find your perfect slice of homemade goodness. Happy baking!

Heavyweight Wrestling | Maximize Your Performance

Transitioning into the heavyweight division in wrestling requires not only physical strength but also strategic mastery of the sport. Here are some invaluable tips to help you make a successful move and excel as a heavyweight wrestler:

Focus on Strength Training:

- Prioritize strength training exercises such as squats, deadlifts, and bench presses to build muscle mass and power.

- Incorporate compound movements into your workouts to target multiple muscle groups simultaneously and enhance overall strength.

Develop Technique and Skill:

- Hone your wrestling technique and skills through consistent practice and drills.

- Work on mastering fundamental moves such as takedowns, escapes, and pins, as well as advanced techniques specific to heavyweight wrestling.

Adapt Your Strategy:

- Adjust your wrestling strategy to capitalize on your strengths as a heavyweight, such as utilizing leverage and controlling the center of the mat.

- Develop counter techniques to neutralize opponents’ attacks and exploit their vulnerabilities.

Improve Conditioning:

- Enhance your endurance and conditioning to maintain peak performance throughout matches.

- Incorporate high-intensity interval training (HIIT) and cardiovascular exercises into your routine to build stamina and resilience on the mat.

Study Your Opponents:

- Analyze the strengths and weaknesses of your opponents to develop effective game plans.

- Study footage of past matches to identify recurring patterns and tendencies, enabling you to anticipate and counter their moves effectively.

Embrace Mental Toughness:

- Cultivate mental toughness and resilience to overcome challenges and setbacks in the heavyweight division.

- Visualize success, maintain a positive mindset, and stay focused on your goals, even in the face of adversity.

Seek Guidance and Coaching:

- Seek guidance from experienced coaches and mentors who can provide valuable insights and support in your transition to heavyweight wrestling.

- Be receptive to feedback and continuously strive to improve and refine your skills under their guidance.

Pay Attention to Nutrition and Recovery:

- Fuel your body with nutritious foods to support muscle growth, energy levels, and recovery.

- Prioritize rest and recovery to prevent injuries and optimize performance, incorporating adequate sleep and recovery practices into your routine.

Build Confidence:

- Build confidence in your abilities through preparation, practice, and experience.

- Set realistic goals and milestones, celebrate your achievements, and believe in your capacity to succeed as a heavyweight wrestler.

Stay Committed and Persistent:

- Stay committed to your training regimen and goals, even when progress seems slow or challenging.

- Persistence and dedication are key to success in wrestling, and consistent effort over time will yield significant improvements and results.

Develop Signature Moves:

- Work on developing signature moves that capitalize on your unique strengths and abilities as a heavyweight wrestler.

- Experiment with different techniques and combinations to find moves that feel natural and effective for you.

Cross-Train in Other Disciplines:

- Cross-train in complementary disciplines such as judo, jiu-jitsu, or Greco-Roman wrestling to expand your skill set and adaptability on the mat.

- Learning techniques from other martial arts can provide valuable insights and alternative approaches to grappling and takedowns.

Utilize Strength and Conditioning Coaches:

- Consider working with strength and conditioning coaches who specialize in wrestling-specific training programs.

- These coaches can design personalized workout routines tailored to your needs and goals, optimizing your physical conditioning and performance.

Attend Wrestling Camps and Clinics:

- Attend wrestling camps and clinics led by experienced coaches and elite wrestlers to gain exposure to new techniques and training methodologies.

- These immersive experiences can accelerate your learning curve and provide invaluable opportunities for growth and improvement.

Conclusion

By implementing these tips and techniques into your training and competition preparation, you can maximize your performance and excel as a heavyweight wrestler. Stay disciplined, focused, and determined, and embrace the unique challenges and opportunities that come with competing in the heavyweight division.